Where’s the bottom?

Later this month, Bain will release its 2016 luxury industry outlook but early predictions have the market bottoming out later this year and rising again in 2017. As usual, China is at the center of all the action. Last year, dramatic stock declines and a crackdown on corruption in China resulted in some of the biggest declines in luxury earnings since the financial crisis, but in-country demand is expected to rise by the end of this year and into 2017.

Luxury Stores in Hong Kong

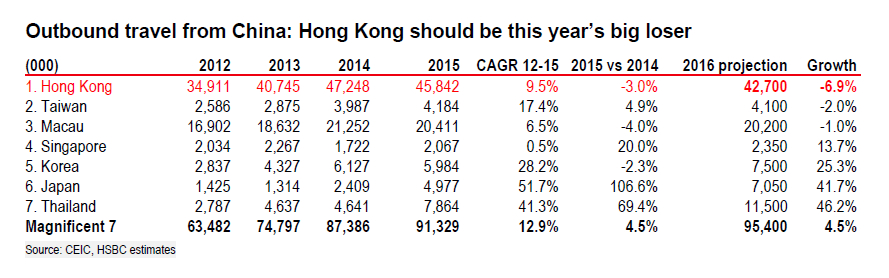

Luxury brands are increasingly dependent on the Chinese consumer. The number of Chinese Travelers from Hong Kong is predicted to decrease this year, which would contribute to decreased luxury spending abroad.

They expect new regulations and tax protocols will result in a significant decline in grey-market imports, thus boosting Chinese domestic demand. Given that luxury retailers have moved to harmonize prices between Europe and China over the past year, there’s also now less incentive to make purchases outside the country. According to the upcoming report, the price discrepancy between Europe and China has been halved in the past year, from 70% to 35%, and is expected to decline to 25% “in the near future.”

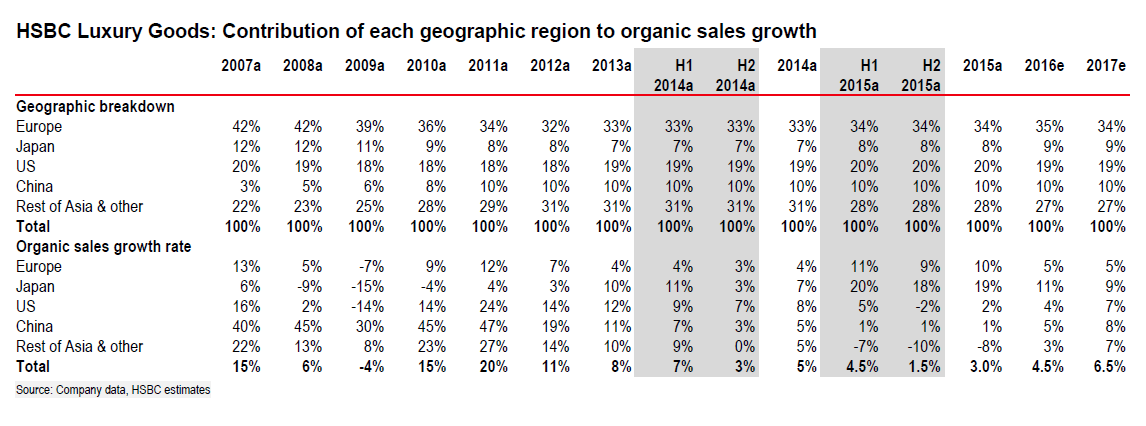

Luxury Sales Growth broken down by Geographic Region

Chinese Shoppers lining up in front of a Hermes Paris store last September.

European sales have obviously taken a serious dip after the most recent terrorist attacks in Paris and Brussels, but this isn’t expected to put any long-term pressure on earnings. In general, there don’t seem to be any identifiable drivers for international demand growth in the forecast, which could prove hugely problematic for already-struggling retailers in the event of some sort of macroeconomic shock.

@miss_clicclac

@pursesandpugs

If you live in China or Hong Kong, we’d love to hear about your experience of acquiring luxury goods and how it’s changing on the ground, if it actually is?

Read related articles below:

China Woes Weigh Heavy on Luxury Market

Luxury Market Expects Weakest Year Since Lehman Crash

The Luxury Market after the Paris Attacks?

Global Price Implications on Chanel Street

Why Western Luxury Retailers Should Still Be Looking East

Love PurseBop

XO

Updated: May 28th, 2017

Comments

1 Responses to “Luxury Market Expected to Bottom Out This Year”

I live in hong Kong and its finally peaceful at H and C. There are no longer anymore queues and the boutiques are finally not crowded like the market. More items are in stock and available at H as H is 30-50% more expensive in HK than in Europe so shoppers are getting smarter and less inclined towards buying at inflated prices. So its usually the overindulging husband or daughter who buy gifts at H. Over at C, classics are almost always out of stock as the price is only 10% more than Europe so there’s no need to hunt all over Europe for any classics especially for slgs. Overall, its a great situation!