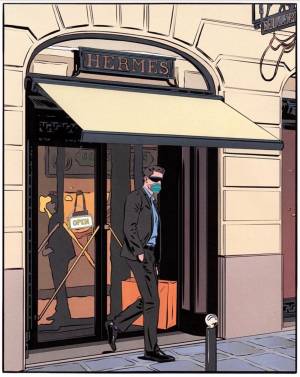

Photo courtesy robbreport.com – Mary Altaffer/AP/Shutterstock

Today WWD put out a bombshell piece of news for the luxury market: the second-largest Hermes boutique in China had $2.7 million in sales on Saturday, the day it reopened after the coronavirus lockdown. If this pent up demand extends to other luxury brands across the country, we could be closer to an answer on the fate of the luxury industry after a global lockdown and meltdown in financial markets.

For over a month, as we’ve covered here at PurseBop (read: The World of Luxury – Post Coronavirus), a heated debate has emerged about what consequences the spread of coronavirus and ensuing market chaos will have on the luxury industry.

On one side are those who argue that as the global economy slides into a recession, luxury brands will be hit the hardest as consumers focus on purchasing essentials and reducing extraneous spending in uncertain times.

On the flip side some commentators argue that the lockdown has generated enormous pent-up consumer demand and we should expect an explosion of retail activity after lockdowns around the world end. This latter “revenge buyers” theory assumes that those participating in the luxury market are less affected by the economic impact than the average consumer currently focused on staple goods.

The exterior facade of the Hermès store in Guangzhou, China.

While industry insiders have jumped on the $2.7 million figure as a glimmer of light at the end of the tunnel, we still think there’s a need for some caution. We’re still fairly bearish on the luxury market as a whole.

For one, the virus has yet to resolve itself around the world. A vast majority of countries outside China are still under total lockdown, with some large luxury markets starting much later than others. It’ll take at least another quarter or two (presuming these countries successfully bend the curve) for businesses to get back to full operations in critical markets in Europe and North America, and it seems highly unlikely Chinese shoppers alone will overcome this loss of revenue. Secondly, with production operations spread around the world, and some important countries shut down for the foreseeable future, the costs of retooling supply chains could be immense.

Thirdly, let’s think about what people do with their bags – they take them out and about. Even if the virus subsides, how long will it take for consumers to psychologically be ready to resume their recreational activities? Will they be more deliberate about their social engagements, resulting in less desire for luxury goods overall?

Only time will tell, but our view from a business perspective is that all the luxury brands will still take a massive financial hit in the coming quarters. How this impacts their strategies and product offerings remains to be seen. Will they flood the market with goods at lower costs to make up for lost revenue, or will they hold back supply until the global economy recovers?

What are your thoughts on all these questions, which side do you fall on in the debate? How willing are you to invest in an expensive handbag if you don’t have any prospects for taking it out on the town anytime soon? Will the economic downturn be too much to weather for even some industry stalwarts, or will revenge buying keep them all afloat?

We’ll continue to watch this fascinating story closely and report back, stay tuned…

Read related articles:

The World of Luxury – Post Coronavirus

Now Chanel is Making Face Masks

Hermès Closes Stores till Further Notice

Impact of Coronavirus on the Global Luxury Market

Coronavirus Continues To Wreak Havoc For Fashion

Louis Vuitton Responds to Government’s Call for Non-Surgical Face Masks

Updated: April 14th, 2020

Comments