Another luxury conglomerate facing declining demand is jewelry darling Richemont, which owns Van Cleef & Arpels (VCA) and Cartier, as well as watch labels IWC, Jaeger-LeCoultre and Piaget, and fashion brands Chloe and Alaïa, among others.

Richemont – with its calendar year beginning April 1, 2024, and running through March 31, 2025 – reported that its first half-year profit dropped 17% to €2.21 billion at constant rates ($2.38 billion), missing analysts’ expectations of €2.45 billion. For the six months ending September 30, 2024, sales fell 1%.

Like many other luxury companies, including LVMH, Richemont faces headwinds in the Asia-Pacific region, particularly in China. This area generally is responsible for about one-third of company revenues. Sales were down 27% in the region.

Richemont CEO Nicolas Bos is reported to have said:

“The confidence factor is probably the most important; it is maybe at an all-time low. We have no clue how long it will last and don’t know if we’ve reached the bottom or not.”

Buffering the results, however, was somewhat sustained demand in Japan, the Americas, and the Middle East which reported sales growth of 42%, 11%, and 11%, respectively. Sales in Europe were up by 4%.

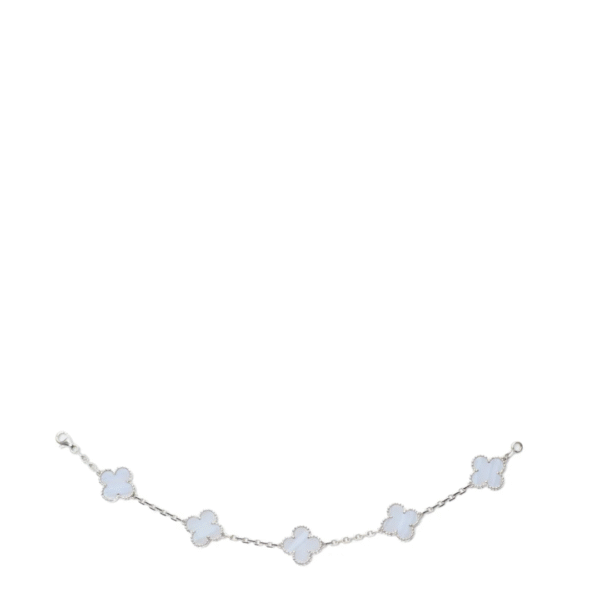

Sales from Richemont’s Jewelry lines saw sales growth up 4% at constant rates, in all geographic areas except Asia Pacific, with the Americas and Japan leading the charge. On the other hand, watch sales declined 16% (at constant rates), again, due to the Asia Pacific region. Japan experienced double-digit growth and sales in the Americas was stable.

Read more about Richemont at Richemont, Reuters, and Business of Fashion

Read also:

Takeover Rumors Buzz As LVMH Head Acquires Richemont Shares

Revenue Growth Slows at LVMH For First Half-Year of 2024

Image courtesy: google gemini AI

- Maura Carlin posted 5 months ago

- last edited 5 months ago