Hermes, Chicago @pursebop

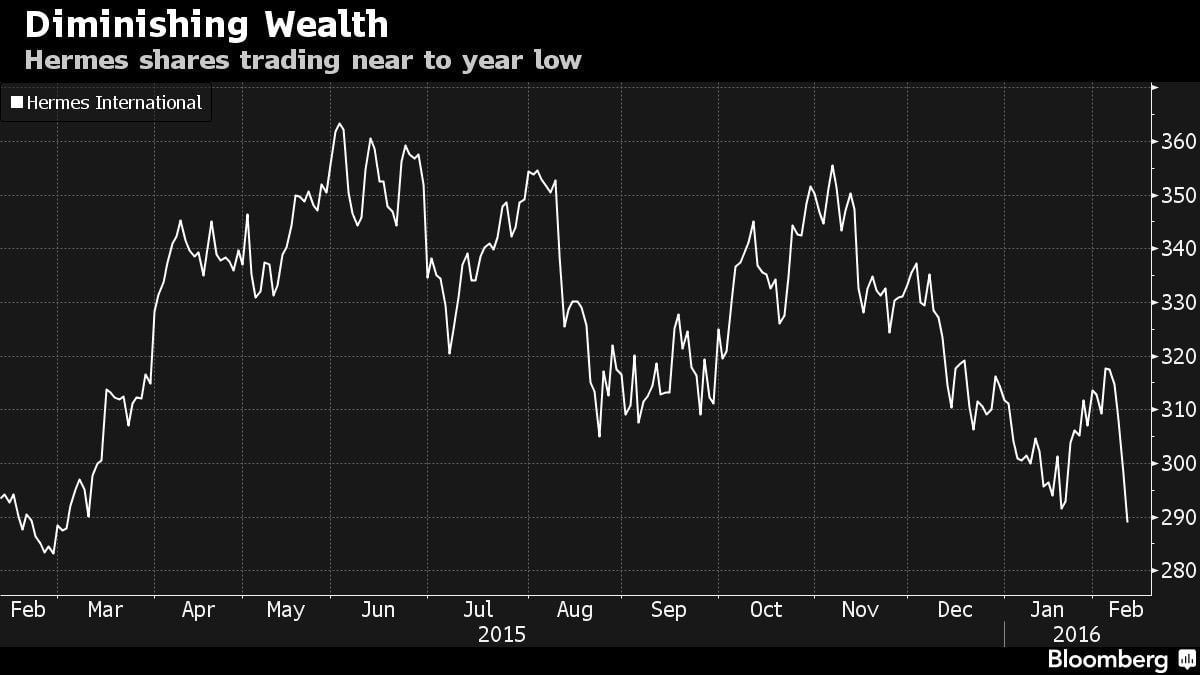

From this week’s news, it looks like the BEAR chasing the rest of the luxury industry is hot on the heels of Hermes too…

(Read: Bear Market for Bags)

The company’s growth in its home market over the last 3 months was significantly lower than the previous two quarters, largely the result of decreased consumer activity following the horrific terrorist attack in Paris: 1% vs 8% and 10% respectively. Hermes had originally targeted 10% global growth in 2016 but with these numbers out of France, that seems almost impossible. While handbag sales in large foreign markets like China remain strong, sales of lower priced accessories and scarves were down 7% last quarter. Hermes shares dropped over 5% on the news, the largest intraday drop since December 2014. Revenue in the quarter grew at the slowest rate in six years.

What’s fascinating to me is how little control luxury brands like Hermes can exert over their success in today’s economy. In a fully globalized world, they blow in the wind just like other less prestigious brands. A decade ago, Hermes seemed immune from the vicissitudes of the global economy. Although that is no longer the case, Hermes does have one distinct advantage the others don’t: legacy. No brand is more respected or loved. How it leans on this storied history to propel growth in the upcoming years is the million dollar question…

Explore more related financial posts:

Bear Market for Bags

Internet Causes Brand Fatigue for Handbag Companies

Are Luxury Brands Losing Their Exclusivity?

From Coach to Hermes: The Luxury Handbag Market

The Increasing Accessibility of High Fashion

Luxury Market Experiences Weakest Year Since Lehman Crash

Bear, Bugs, and Karlito: Trinkets are NO laughing Matter

Love PurseBop

XO

Picture from PurseBop’s upcoming reveal: Part IV Hermès Faubourg Saint- Honoré

@mrs_bcworld

@bycamelia via @thecoveteur

Hermes Fine Dining @pursebop (read here).

Updated: May 28th, 2017

Comments