Topping a recent news story was the headline that “big brands can’t always be dependent on the ultra-rich.” But, what if they can? Depending on the brand, and, of course, the definition of rich, ultra-rich, or uber-rich. Indeed, for some of the top luxury brands, recent moves suggest a precise targeting of that elite consumer.

Image courtesy @maymay_savan

But, let’s backtrack first and examine the cause of the consternation. Over the last week or so, the stock prices of some luxe purveyors have dipped substantially. Specifically, during the week of May 23, Hermès, LVMH, and Kering lost a combined $60 million in market value. Paper losses at this point, but still. The CAC 40 Index (a benchmark French stock market index) ended the month of May down 5.24%.

Personally, LVMH’s CEO Bernard Arnault took the biggest hit. On a single day, he saw the value of his accounts drop $11.2 billion. Just yesterday (May 31) he lost the title of world’s wealthiest man, which has vacillated between him and Elon Musk for months, as the LVMH stock price declined another 2.6%. For the moment, if you’re keeping tabs, it’s Musk $192.3 billion, Arnault $186.6 billion. Doubtful there are many tears being shed for either man.

The real question, of course, is why the stock prices of these firms are declining. It’s probably not based on past results from 2022 or Q1 2023. In fact, the recent financial reports from our favorite brands were largely positive. Double digit growth, rebound in China, albeit for LVMH a slowdown in U.S. sales, all sound good. But the stock markets look forward . . . what’s on the horizon. And the long-predicted economic slowdown seems to be inching closer. The latest news, though, is that the economy in China is slowing. And that is where the problem lies.

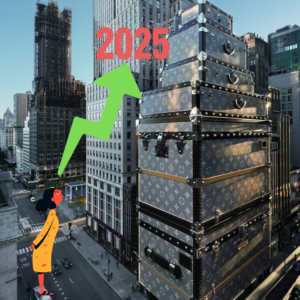

After the last few years of on and off health restrictions in China, limited travel, shuttered stores, brands were looking forward to the continuing rebound in China. After all, it is the largest market for luxury goods. A recent Bain & Co. report estimated that by 2025 Chinese consumers would account for 46% – nearly half – of the global luxury market. But that report came out in February, when things were looking rosy.

Of course, tomorrow could bring different news, and an upward change in stock prices. Or not.

The real question is who is going to purchase – or continue to purchase – top-end luxury goods. The aspirational buyer, newer to the brand with less disposable income, not surprisingly will be the first to retrench, particularly when facing inflation. Higher prices for everything mean less for splurges. And although brands have made an effort to offer products for new entries to the brand – think Hermès Beauty – bigger ticket buys may decline.

Image courtesy @my_fashion_alchemy

Even the medium-rich could feel the pressure of cost of living spikes combined with massive stock portfolio losses. It may be hard to justify a $10K spend on a Hermès bag, or Chanel for that matter, when everything else costs more. Choices get made, even for the ultra rich; perhaps opting for a new handbag rather than a stay at the Ritz in Paris.

However, the golden group – the uber-rich – for Hermès, Chanel, and Louis Vuitton are least affected by the more mundane price hikes hitting most of us. And that explains why we hear so much about them catering to VICs and VIPS (very important clients/persons). Those are the shoppers who can and will buy no matter the economy. For these customers, brands are rolling out the red carpet, providing unmatched luxury experiences in and out of boutiques.

Image courtesy @chloeiscrazy

For all of the complaints about access to bags being limited to spenders above a certain level, or pre-spend “requirements”, the uber-rich probably aren’t complaining. They already spend or have dropped more than “required.” Their SAs cater to them in a way not provided to most others. They have access to bags everyone wants, but few can afford.

And, we suggest that brands may be hanging their hat on hanging on to these clients. They will get them through an economic downturn in a way the broader clientele cannot.

xo,

PurseBop

Updated: June 2nd, 2023

Comments

1 Responses to “Can the Uber Rich Be Enough for Hermès and Chanel to Stay on Top?”

Hello Purseblog, please get someone to contact me via email about advertising.

I am JIMMY from http://www.JimmysOffice.com, I happen to be here right now in Milan, wondering how NO ONE YET HAS MY CELL PHONE CASE??.

Will be the entry level fashion/technology item…..guess who i am seeing here in Milan on Tuesday…..