Yes Chanel aficionados, you read that correctly. There’s another justification for “investing” in your favorite handbags. Our headline comes directly from a recent financial report, which discusses categories of collectibles like art, wine, watches, and, to a more limited extent, handbags.

Not surprisingly, this discussion focuses on bags. Our site is PurseBop after all. However, Rolex fans also may be pleased to learn that those watches are considered best investments. Perhaps even better than other timepiece brands.

That Credit Suisse and Deloitte Luxembourg concluded Chanel bags were strong in an inflationary and volatile economy is, of itself, fascinating. And when you delve deeper to see why the Chanel flap and not, as has been the case for other luxury indices in the past, the Hermes Birkin (or Kelly), we begin perhaps to understand just how Chanel’s strategies may be working in its favor.

But first, the report. Issued jointly by Credit Suisse and Deloitte Luxembourg in June 2022 and titled Collectibles Amid Heightened Uncertainty and Inflation, it examines recent collectible trends in light of events of the last two years. The Executive Summary first notes the pandemic and geopolitical challenges of 2020 and 2021 (and continuing). After acknowledging that the luxury handbag category fared fairly well:

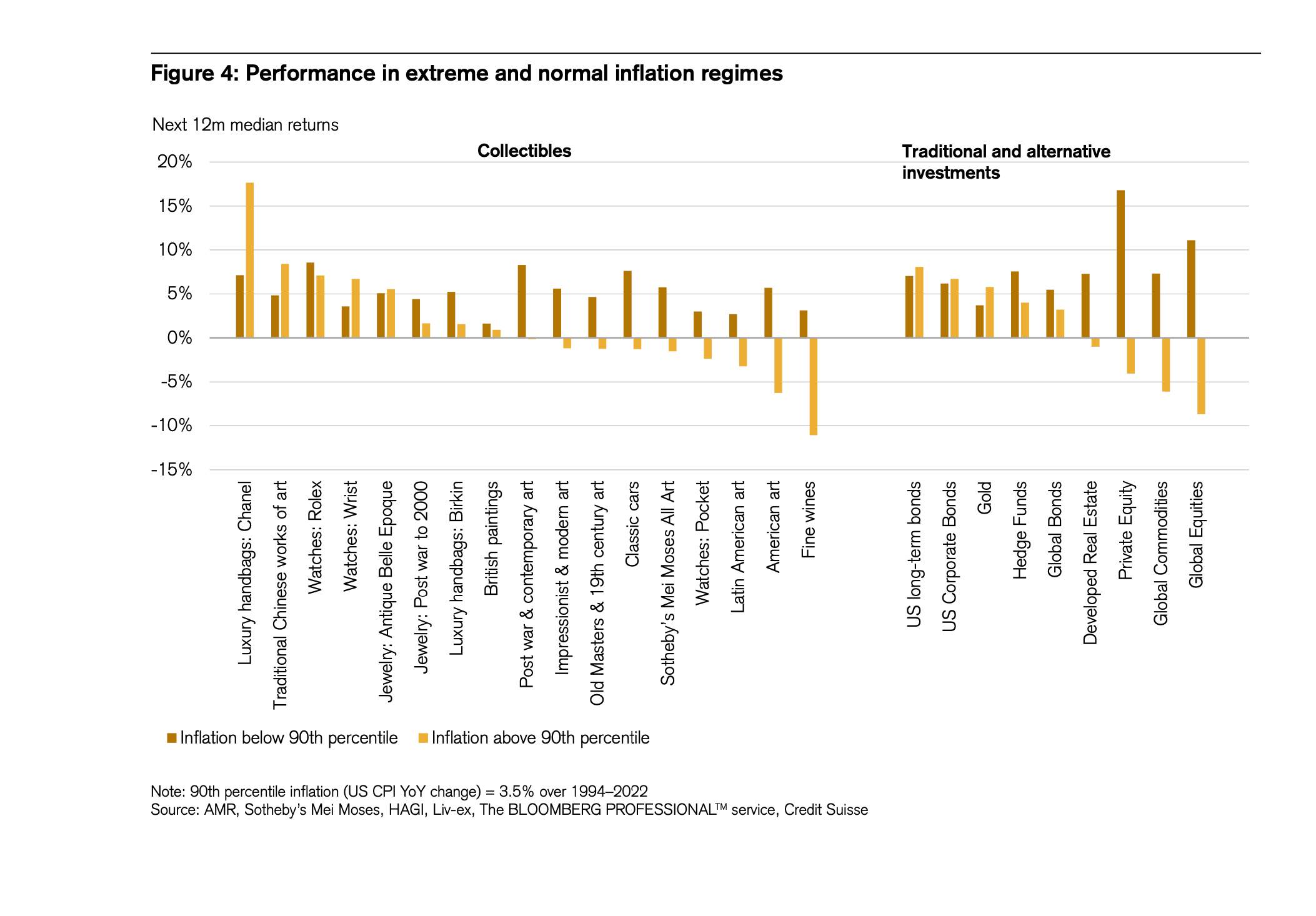

We find that Chanel handbags, traditional Chinese works of art and wristwatches offer the best inflation protection, while fine wines, modern and contemporary art, and American and Latin American art tend to suffer in high-inflation regimes.

Quite a headline. Almost makes you run out to your nearest Chanel boutique and buy out the collection of handbags. As if you could.

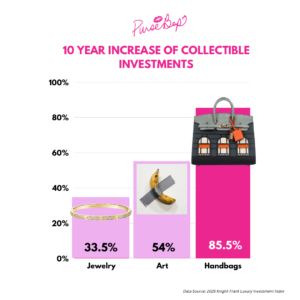

Since that’s not possible, we continued reading the report. In the world of collectibles, despite the difficulties of 2020, apparently the returns on collectibles sold were “reasonably good.” Luxury handbags (as compared to classic cars and watches) rose more strongly (+11.8% for Chanel bags and +38% for Hermes [sic] Birkin bags.” But we already knew that.

The discussion then turns to 2021. As economies reopened, collectibles boomed in terms of sales and performance, but there was variation within categories. And that there was, for Chanel and Hermès. According to this report:

Chanel handbags rose by 24% (likely boosted by the scarcity of Lagerfeld-designed bags) and standing in stark contrast to Birkin bags (-3.6%)”

Credit Suisse & Delotte, page 16 – note Chanel versus Hermès

So why the difference? Simply put, the scarcity and lower volatility of Chanel bags. Specifically, the report says Lagerfeld-designed bags (we’ll get to that later) “are likely to continue to benefit from the scarcity effect in the next few years… but the brand’s broader evolution in luxury handbags will be determined by the ability to sustain collectors’ excitement going forward.”

In contrast, it asserts that Birkins have had more volatility “more comparable to that of global bonds or hedge funds among financial assets, but a better risk-reward than the latter”. Put another way, Birkin pricing at resale is subject to greater variability.

Perhaps an example will help. Hypothetically, let’s consider a Chanel flap purchased in December 2021 from a reseller. Upon resale in December 2022, if unused, that bag might fetch around the price originally paid. Maybe a bit more, or a bit less, but generally speaking, not a huge swing.

On the other hand, look at one of the hottest Hermès bags around right now – the Mini Kelly 20. Virtually impossible to obtain at a boutique, in December 2021 you’d have to shell out around $30,000 to a reseller. Fast forward a year later, and there’s no guarantee you’d get anything near that price if you rehome it, even if unused. Whether it sells for $30,000, $20,000, or $10,000, is much harder to predict, particularly in uncertain economic times.

Read: Deep Dive Investigation Into the Popularity and Values of the Hermès Mini Kelly 20

With this example, it’s easier to understand how volatility can affect which bags are better collectible investments. At a time of uncertainty, investors want stability. And hence, presumably Chanel flaps over Birkins.

But that’s only for those considering collectibility and investment. Many handbag lovers consistently select a Birkin or Kelly over a Chanel flap.

However, are all Chanel flaps created equal? Let’s discuss the report’s repeated characterization of Chanel’s “Lagerfeld-designed” bags. Designer Karl Lagerfeld passed away in January 2019. Clearly, he is no longer designing bags. And yet, it’s clear CS and Deloitte are not addressing purely vintage handbags.

Then, one wonders to which bags the report is referring. We suspect CS and Deloitte are looking at the Classic Flap, which essentially became iconic during the Lagerfeld era. Moreover, the staggering price increases in the last two years resulted in the price of the medium Classic Flap more than doubling, from $5800 in October 2019 to $8800 (as of June 2022).

Just as not all Hermès bags are uniformly coveted, the same appears true for Chanel. Extrapolating from the report, it’s the Chanel Classic (aka Iconic) flaps that will stand the economic test of inflation as collectibles. And, more to the point, likely, not the other styles of Chanel bags.

Of course, for those clamoring for a new Flap, inflation cannot be good news. Chanel substantially hiked prices during a global pandemic and economic crisis. The reason: purportedly increased costs were a partial excuse. Well, inflation is only going to make things more expensive. And who do you think is going to pay?

Love, Pursebop

XO

Read Related Articles:

The Surge in Demand for the Chanel Vintage Maxi Flap

Here’s Why Chanel is Going to Open Private Boutiques

Apple Stock or Chanel Flap… Guess the Better Investment

The Best Classic Handbags to Invest In Now

The Financial Reasons Why the Hermes Birkin is an Investment

Updated: June 23rd, 2022

Comments