Everyday it seems there’s a different article about the doom or boom of the luxury goods market. One day it’s set to expand to new heights on the back (or backpack) of the ultra-wealthy and sales in China. The next (or hours later) no one is buying expensive items and China’s economy is not rebounding. Of course, no one really knows how the economic and geopolitical international crises will play out or affect the luxury goods industry. Stock prices of these players fluctuate based on the news of the day. One stock facing disappointing revenues can bring down the entire sector, and another can bring it up.

Image courtesy: @thestylishfreelancer

Then, there’s the question of how it affects your ever-growing handbag collection. Do fewer potential buyers mean more bags available for you? Not necessarily, if brands decide to produce less, either to maintain exclusivity or cut costs. Will prices lower? Absolutely not, but perhaps they won’t rise quite so quickly . . . unless increasing price is the way to stave off poor financial results. Just look at the price hikes Louis Vuitton and Chanel imposed during the height of the pandemic.

At the same time, some brands are making it even more difficult to purchase their coveted goods. Hermès always is expert at this, but in recent years Chanel and Louis Vuitton got in on the action. Chanel, for example, has imposed limits on the number of Classic handbags you can purchase in a year. Louis Vuitton has taken its favorite tote, the Neverfull, off the shelves and made it only available by pre-order, at the time and price it determines. . .

Image courtesy: @thestylishfreelancer

Image courtesy: @fatmako

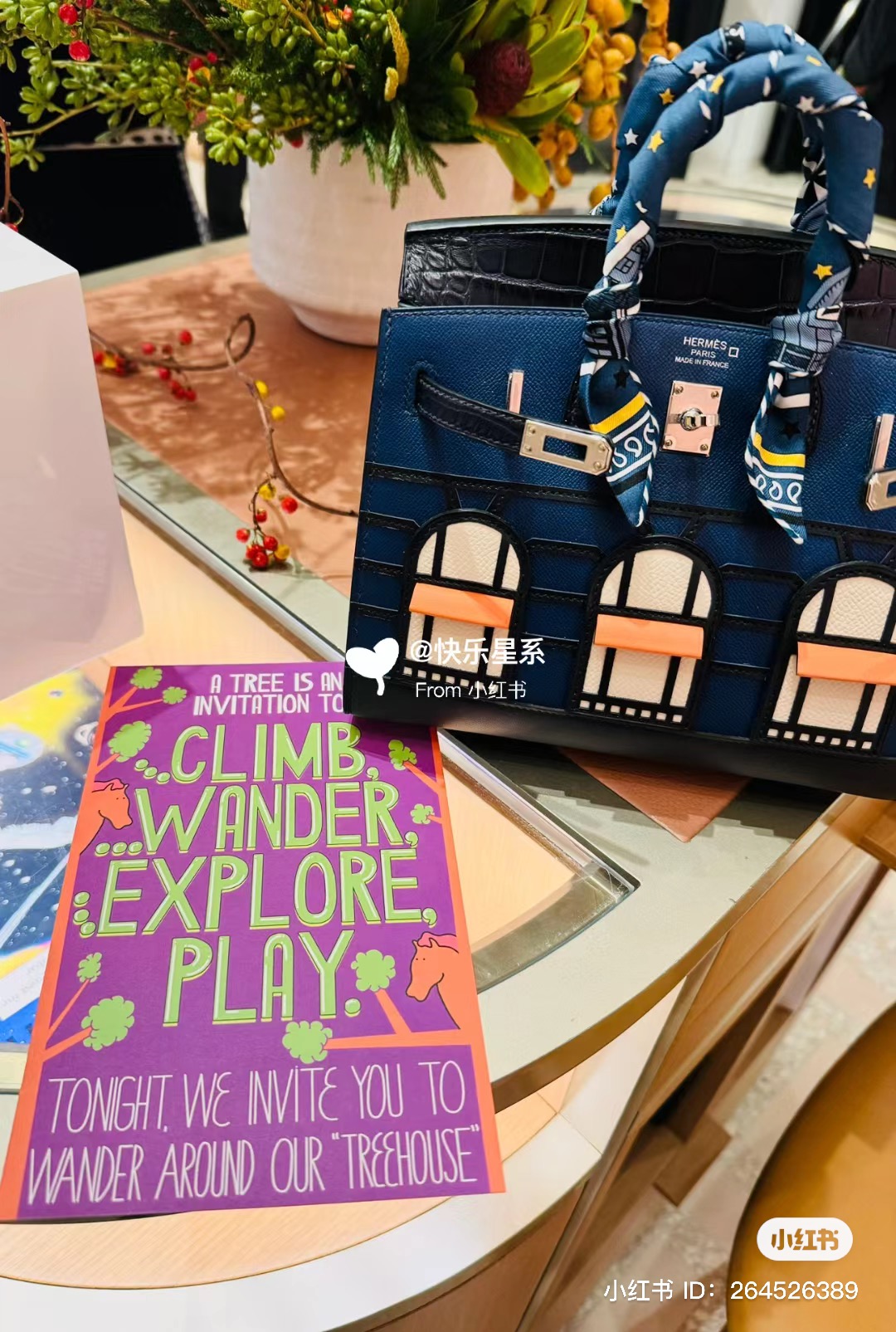

Unless of course, you’re a VVIP. Then, anything goes. Suddenly handbags unavailable to the general masses able and willing to part with (only) five figures – still a limited segment of shoppers – magically appear. There’s no limit on Hermès quota bags even in exotic and rare fabrications. Want a Chanel Classic flap in all the colors of the rainbow? Sure, come and get it.

Additionally, VVIPs are welcomed to private salons for shopping. Experience the opulence of the brand in special curated experiences and events. You are wined and dined, and given access to nearly anything you care to buy.

With such stratification in the treatment of customers, it’s no wonder everyone wants to be a VVIP. Or at least be treated like one. And the price of entry is far from the cost of one or two luxury items. So for the sort of wealthy – or HENRYs (high earning not rich yet) – there’s a frustration that even if able to purchase a $10K+ Chanel bag, Chanel might not sell it to them. The same for Hermès. It remains to be seen whether this unrequited love makes the heart grow fonder or pulls you further apart.

Really, though, there is more of a multi-tier system for luxury goods when you include the “aspirational” consumer. LVMH considers this to be the purchaser earning under $100K per year (The ‘aspirational’ luxury shopper is suffering, but don’t expect any deals) whose purchases fueled LVMH record profits in 2022. And by LVMH and other brand accounts, this customer is feeling the effects of inflation and other economic problems and has pulled back on purchasing in 2023.

Image courtesy: @m.t. 1968

Additionally, the aspirational customer has been hit hardest by the huge price increases imposed by brands over the last number of years. Much like sales tax, it hits lower income groups harder. Imagine you were planning and saving for that Chanel flap. With the price rising 50% from $6800 in 2021 to $10,200 in 2023, it’s hard to keep up.

As quoted in a recent New York Times article, Vanessa Friedman, its Fashion Director and Chief Fashion Critic, poignantly said:

“Well, the 1 percent are the target market for high fashion. The rest of us are left with perfume and lipstick.”

Image courtesy: @my.simple.style

Interestingly, that article, in print, was titled “To Understand Luxury Economics, Study Psychology.” When it comes to luxury goods like uber high-end handbags, pricing doesn’t quite make sense. Notwithstanding the steep prices for Hermès and Chanel bags, demand continues to rise. Unless you understand Veblen goods.

“A Veblen good is a good for which demand increases as the price increases. Veblen goods are typically high-quality goods that are well made, exclusive, and a status symbol. Veblen goods are generally sought after by affluent consumers who place a premium on the utility of the good.” Investopedia

“Well made, exclusive, and a status symbol” is where psychology comes in. These handbags are not anything we need but rather represent high-quality items we desire as part of our style, image, and status. The fewer people that have them, the more special and exclusive the item. In this setting, higher prices just make it more desirable.

Image courtesy: @stellaw2021

Image courtesy: @stellaw2021

For as much as brands are courting the super-wealthy, it seems unlikely that they can give up on the newer and lower-end buyers. After all, there’s lipstick and perfume. Gen Z is expected to account for 25-30% of luxury market purchases by 2030, and millennials 50-55%. They need an entry point to the brand. Perhaps that explains why many of these high-end purveyors continue to add additional entry-level product lines. Hermès has created its beauty line. Chanel has SLGs. And Dior now has a baby perfume and skincare line.

Image courtesy: @mm_mimosa

With this in mind, let’s look at the recent data. Bain & Company, along with Italian Trade Group Altagamma, released its second report this year about luxury market growth. According to Bain, the personal luxury goods market in 2023 is expected to grow 4% over 2022. Estimates about size have been revised downward to €362 billion, or the lower end of the range of the earlier predicted €360-380 billion. The report notes that the fourth quarter of 2024 will be affected by “fragile consumer confidence, macroeconomic tensions in China, and sparse signs of recovery in the US.” As for 2024, “research suggests a softening personal luxury goods performance in 2024, achieving low-to-mid single-digit growth over 2023, based on current scenarios.”

Claudia D’Arpizio, a Bain & Company partner and leader of Bain’s global Luxury Goods and Fashion practice, the lead author of the study said:

“This is a defining moment for brands, and the winners will separate themselves through resilience, relevance, and renewal—the basics of the new value-centered luxury equation . . . The luxury market is generating positive growth for 65-70% of brands in 2023, compared to 95% in 2022. To stay in the game, it will be crucial for brands to take bold decisions on behalf of their customers.”

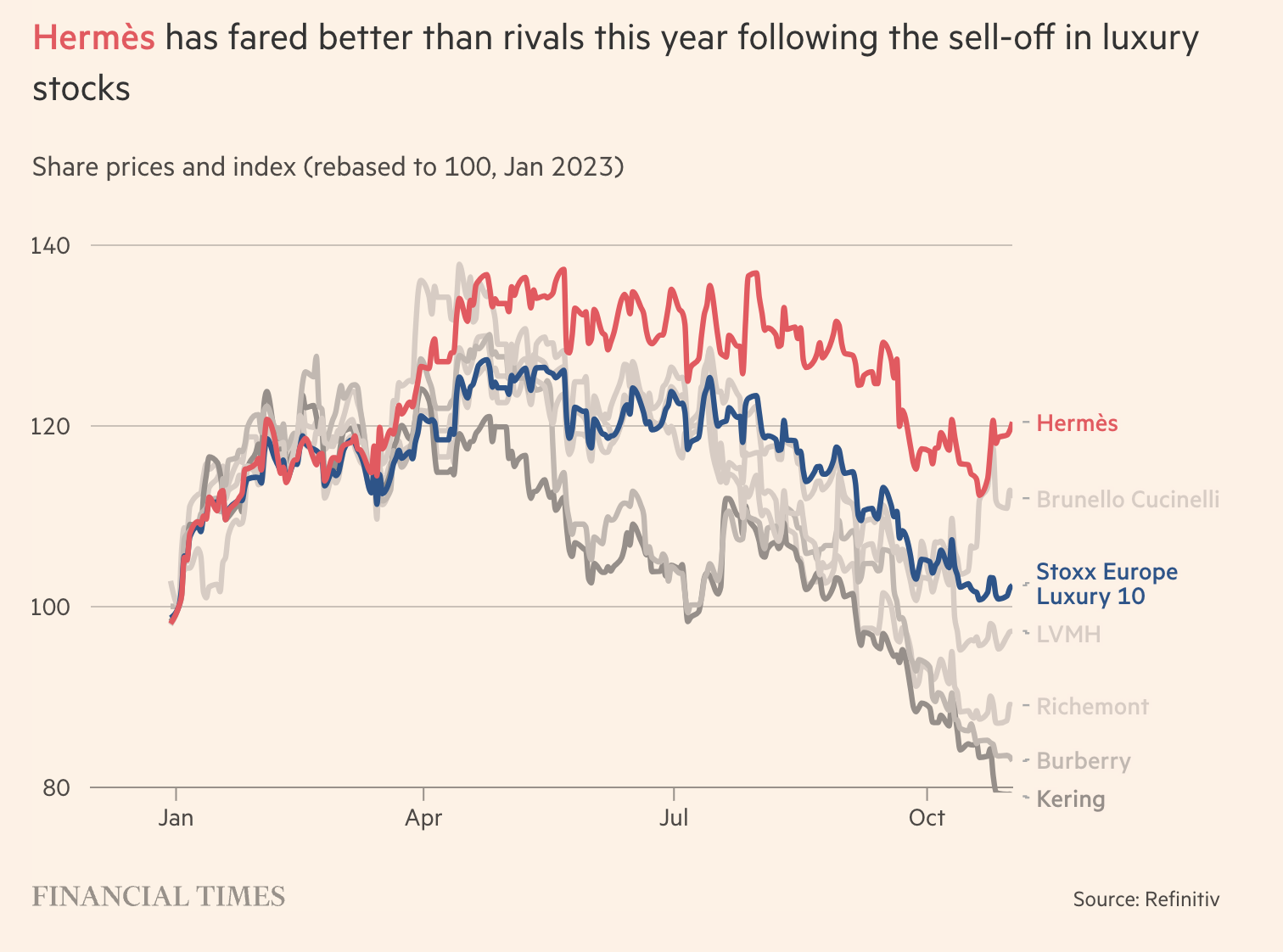

Put differently, just as there exists a hierarchy of luxury good consumers, the same is true of the luxury fashion brands. First nine months and Q3 2023 financial results bear this out. Hermès fared better than LVMH and denied a decline in the aspirational consumer’s purchases. Indeed, Hermès beat analyst’s expectations, whereas LVMH did not. And LVMH’s Fashion & Leather Goods Group as a whole (LVMH does not report on a brand basis) experienced a slowdown in growth in this period. Kering’s brands like Gucci, Bottega Veneta, and Balenciaga all declined in this Q3/nine month period of 2023. Chanel, as a private company, does not provide quarterly reports to the public.

Image courtesy: Financial Times

It will be interesting to see how brands other than Hermès adjust to the fluctuating economic circumstances. Will any raise prices to create an image of prestige? Or reduce supply in the name of scarcity and exclusivity? Yet, they need the aspirational consumer and a new younger generation of customers. Stay tuned.

Read related articles:

LVMH Revenues Grow, But More Slowly Based on 2023 Q3 Results

Updated: December 18th, 2023

Comments