Dear PurseBop:

What happens if you weren’t able to get a customs stamp (short layover) in your last stop of Europe of the trip where the item was purchased? I have another trip about three weeks later to Europe. Am I able to do the refund at the airport then?

Dear Customs Stamp for VAT Refund:

VAT rules in Europe state that you have 3 months plus the month the Tax Free Form was filled out to obtain the customs validation stamp. Once the form is stamped it is valid for 6 months from the issuing date of the Tax Free Form.

Since you were unable to have your Form stamped when you left the EU on your first trip, you may obtain the stamp upon leaving the EU on your second trip as long as more than 3 months has not elapsed since your first trip. Upon your return to Europe have your VAT Tax Free Form validated at the airport before you depart to fly home. Be sure to have your purchases with you in your luggage to show the customs officer if requested.

Items that cost 100.01 euros or more may have the VAT refunded for shoppers who are permanent residents in a non-EU country. Refundable items that are unused are eligible for a tax refund.

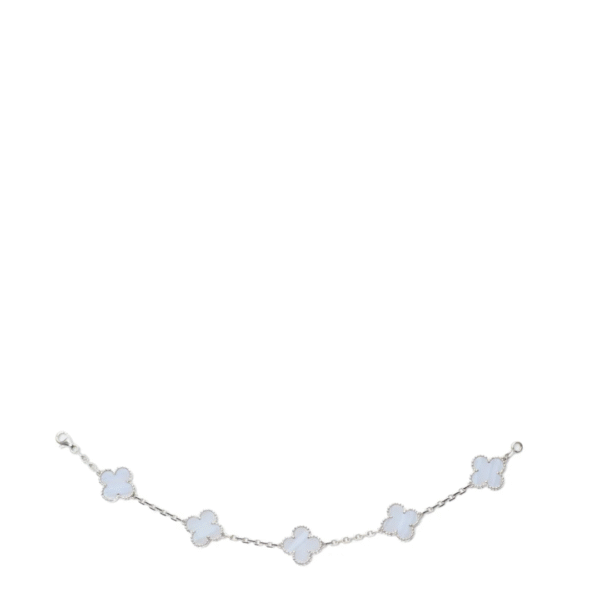

photo courtesy @karenzpurses

- Karenzpurses posted 1 year ago