Dear PurseBop:

I am traveling to multiple European countries this summer. If I am shopping in each country and receive VAT refund forms where and when should I process them? When I leave each country or when exiting my final destination before flying home?

Dear Traveler with VAT Refund Forms:

Based on our personal experience we believe you should process your VAT refund form(s) before leaving each individual country where you shopped. The VAT refund will be processed much faster if they are submitted in the country where the purchases were made.

If you process VAT refund forms from a different country than where the purchases are made, the form is then mailed to that country for processing. This delays the process of when you receive your refund.

Our recommendation is to shop in each country but before traveling to the next country, process your VAT refund forms in the airport or train station before leaving the country where the purchases were made. They will be processed faster and you should receive your refund in 1-3 weeks.

Share your summer shopping experiences and VAT and customs experiences with us here.

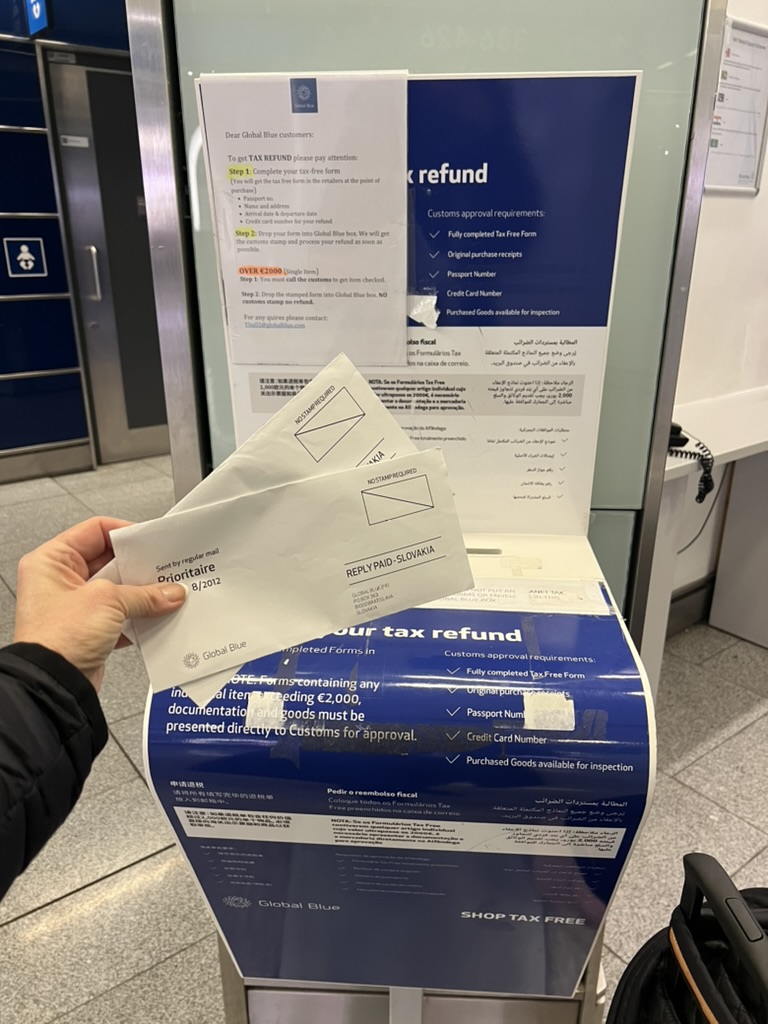

VAT refund box in Dublin Airport

- Karenzpurses posted 10 months ago