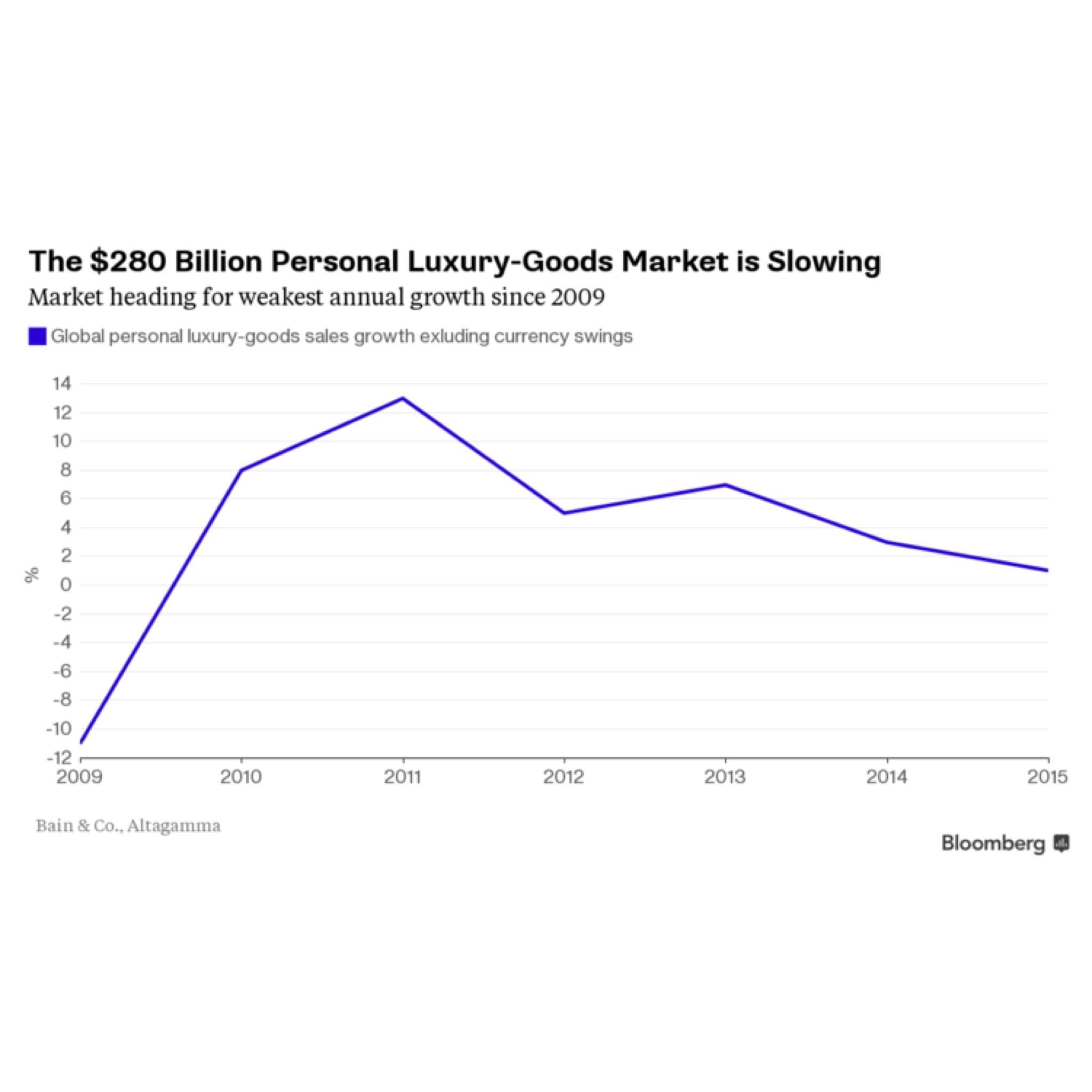

2015 hasn’t been the best year for the luxury market. I guess that’s an understatement…it’s been downright brutal. We knew after the summer that numbers from China weren’t going to be great, that European consumers weren’t too pleased with price increases, but also that American tourists were heading to Europe in droves to take advantage of their strong dollar. There was a thought that maybe the industry could climb out of the hole and at least post respectable numbers by year’s end, but I came across a Bloomberg story with a title that was quite ominous: “Luxury Market Heading for Weakest Year Since Lehman Crash”.

“Ring around the Rosy…We all Fall Down” may unfortunately be the anthem for Chanel, Louis Vuitton and Hermes soon

According to data from a recently published Bain & Co. report, luxury sales will only grow 1% in 2015, the lowest amount since an 11% tumble the year after the investment bank Lehman Brothers went bankrupt. Remember 2007-2009? The financial world as we knew it was on the verge of caving in on itself. While the global economic situation has surely improved, these numbers are a frightening reminder that global volatility might be with us for a while. Luxury sales will fall for the second consecutive year in China while the US will see no growth. We should supposedly only expect 2-4% growth forward, but even that seems hard to achieve right now.

The only saving grace for the industry is that there are deep product markets in places with weak currencies, like Europe, leading to higher sales from tourists. Globally, Chinese shoppers now account for a third of luxury spending, an increase from 28% in 2014. While an expanding middle class with a preference for western goods should at least provide a floor for sales growth, how are LV, Prada, Gucci, Hermes, and others going to thrive? What do they need to do to boost sales in their traditional home markets in Europe and North America? As a prospective customer, what do you definitely NOT want to see them do?

Let’s take this conversation to the BopTalk threads.

Love PurseBop

XO

Updated: May 28th, 2017

Comments

1 Responses to “Luxury Market Expects Weakest Year Since Lehman Crash”

more price increases will be the worst thing to see.