What goes up doesn’t always go up, and that appears to apply to the luxury goods industry right now. Consulting firm Bain & Company expects global luxury spending for the remainder of 2024 to remain flat, with consumers choosing luxury experiences – such as travel, dining, and entertainment – over purchasing high-end goods. According to Bain, for the first time since the financial crisis of 2008 (excluding the Pandemic), the personal luxury goods market is expected to remain relatively flat. At least for 2024, and likely 2025.

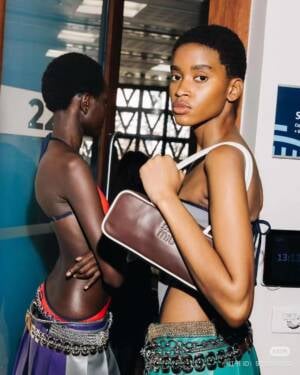

@ninoska_malik

Bain partner and leader of the global Fashion & Luxury Practice, says “50 million luxury consumers have either opted out of the luxury goods market or been forced out of it in the last two years.” Bain sees Gen Z in particular, as being less inclined to splurge on luxury items, whether by choice or necessity. This shift forces brands to rethink how to attract this younger demographic while retaining established clientele. Adding to the difficulty are the economic woes and low demand in China – once the industry’s growth engine, deeply affecting the bottom lines of many luxury companies.

Pointing to economic uncertainty and price increases, Bain says luxury consumers are spending and buying less. This comes as no surprise, in light of Q3 financial results for many of the largest luxury brands. For example, LVMH’s Fashion & Leather Goods division – which includes brands like Louis Vuitton, Dior, Celine, Loro Piana, and Loewe – saw a 5% drop in revenues in Q3 2024 compared to the previous year, despite a flurry of new releases, and limited-edition collections.

Read also: Q3 Unravels: LVMH Handbag Sales Slip by 5%

Other luxury companies faced similar results. Kering – the parent company of Gucci, saw a 16% drop in Q3 sales compared to 2023, while Burberry’s revenues declined by 20%. Richemont, the owner of Cartier and Van Cleef & Arpels, also reported a 1% drop in revenues.

Image courtesy: @the.webcloud

However, there were bright, or brighter, spots in the luxury industry. Hermès continued its upward trajectory, albeit at a slower pace. The company’s largest division, leather goods and saddlery posted a 17% revenue growth this year – driven, of course, by sustained demand of the Birkin and Kelly, alongside the reintroduced Constance Élan.

Read also: Hermès Reports Solid Q3 Growth, Driven by Iconic Bags and New Designs

Image courtesy: @faye_tsui

Prada’s popularity has also surged, fueled by the continued success of its MiuMiu label, and Brunello Cucinelli also saw positive results. Meanwhile, demand in the Americas, Europe, and Japan remains steady, if not strong.

Looking ahead, Bain anticipates new regions to drive luxury growth, particularly emerging markets such as India, Southeast Asia, Latin America, and Africa, where a growing affluent population presents fresh opportunities for luxury brands.

Read also: Are Luxury Goods Just for Boomers?

Image courtesy: @tamara

Despite current challenges, the industry’s resilience and ability to innovate will be key in navigating this period of uncertainty. Only time will tell if the luxury goods market will see a resurgence in 2025.

Updated: November 23rd, 2024

Comments

1 Responses to “Luxury on the Rocks: Fact or Fiction?”

I aim to enlighten those who wants to be elevated and taken out of deep shallow hole, crypto investment is like a dark shallow when you end up with a wrong one(scammer) and it feels lively when you make a good choice(legitimate traders) how do I know am with the righer trader, e.g rating by website: Brunoequickhack.COM and their machinery compose words will lead you astray, you have to make use of insights and understanding the logic about what you are getting into, I Selina Brad was a victim of stock investment, I learnt all this lesson and expressed during my search for a recovery hacker of whom I stumbled at after being through several scammers (Brunoe Quick Hack) WhatsApp:+1705-784-26-35 helped in getting my funds recovered. I owe him a big thanks, Please do reach out to him. Email: Brunoequickhack(AT)GMAIL.com