Are the years of spiking values for luxury investments over? According to the 2025 Knight-Frank Luxury Investment Index (KFLII), 2024 was a rough year. Calling it “The great luxury correction,” the KFLII 2025 Wealth Report points to changes in the investment calculus as the stock market roared. The nearly two-decade old KFLII – which includes jewelry, coins, watches, cars, whiskey, wine, art, and more – experienced an overall decline of 3.3% in 2024, compared to 2023.

“As financial markets soared in 2024, the [KFLII] fell by 3.3%, leaving collectors and investors to navigate a changing landscape where scarcity no longer guarantees returns.”

Image courtesy: Knight Frank Luxury Investment Index Wealth Report, 19th ed (2025)

The brightest spot in 2024, however, was investment handbags. The value of this investment category grew 2.8%, a 6 point swing from the overall KFLII. But let’s be clear – the KFLII doesn’t consider all handbags, just the special and hard-to-get types like Birkins. Sebastian Duthy of Art Market Research provided additional insight that

“the ultimate classic handbag, the Hermès Birkin in black Togo leather, is now more valuable than ever when sold on the secondary market.”

And even for handbag lovers, considering (and purchasing) these items as investments can be challenging when your stock portfolio is shooting up.

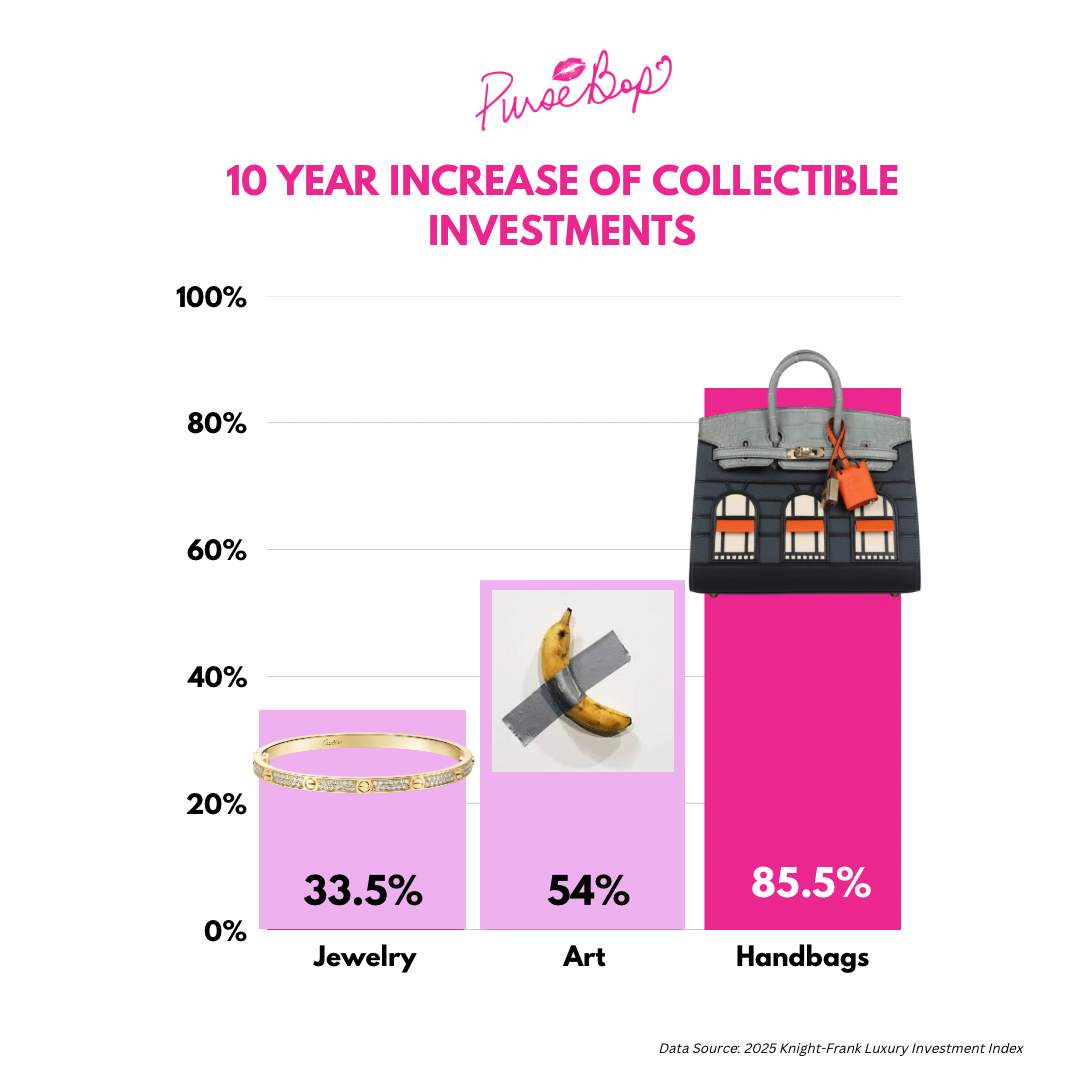

Looking back over the past five years, luxury investment handbag value grew 34%, eclipsing the luxury investment category as a whole. However, when you look back over a wider horizon, ten years, in the early years, value growth was at a sharper clip. In the last decade the KFLII for handbags grew 85%.

According to the 2025 KFLII, Art (-18%), wine (-9.1%), and whiskey(-9%) were the big losers in 2024, clearly bringing down the entire KFLII.

Birkins from Heritage Auctions

Has your view of handbags as “investments” changed over the last year? Let us know.

Love, PurseBop

XO

Updated: April 1st, 2025

Comments

1 Responses to “News: Handbags Reported as Must-Have Investment of 2024”

As a victim of a scam, I was impressed by the exceptional service provided by Cyberspace Hack Pro. Their team demonstrated expertise and dedication to recovering my lost funds.

– Professional and efficient service

– Expertise in tracking down scammers and retrieving funds

– Dedicated to customer satisfaction

I highly recommend Cyberspace Hack Pro to individuals who have fallen victim to scams. Their services are reliable, trustworthy, and effective.

Contact info

https://cyberspacehackpro0.wixsite.com/cyberspacehackpro

Email: Cyberspacehackpro@rescueteam com

WhatsApp +1 (559) 508 2403