We all hear, say, and believe that an Hermes Birkin is an “investment,” but what exactly does that mean? After all, “Investment” can be used to describe a number of things. Does the value of the bag periodically increase, allowing one to recover their initial investment and earn profit? Or is the Birkin bag an investment in terms of longevity? Rather than purchase lower quality products, and subsequent replacements, are Birkins actually a cost effective strategy for the savvy shopper?

Image Courtesy: Christie’s Images Limited

The answer may be both, and therein lies the inherent uniqueness and prowess of a Birkin bag. Unlike other brands, Hermes is one that boasts multiple stronghold staples that top the luxury handbag pyramid. Birkin and Kelly bags are arguably the most coveted handbags in the world. Coupled with Hermes’ strategic marketing and strictly controlled supply chain, these bags command prices equivalent to that of a small car. Some bags may even approach the price of a home. The Birkin specifically has been the object of desire of almost everyone in the luxury market for decades. Fast forward to today, the Birkin has found itself positioned as a lucrative investment instrument. The bag yields an equal or greater ROI (return on investment) than traditional ventures like stocks, but with the added benefit of lower risk, given the power of sustained demand.

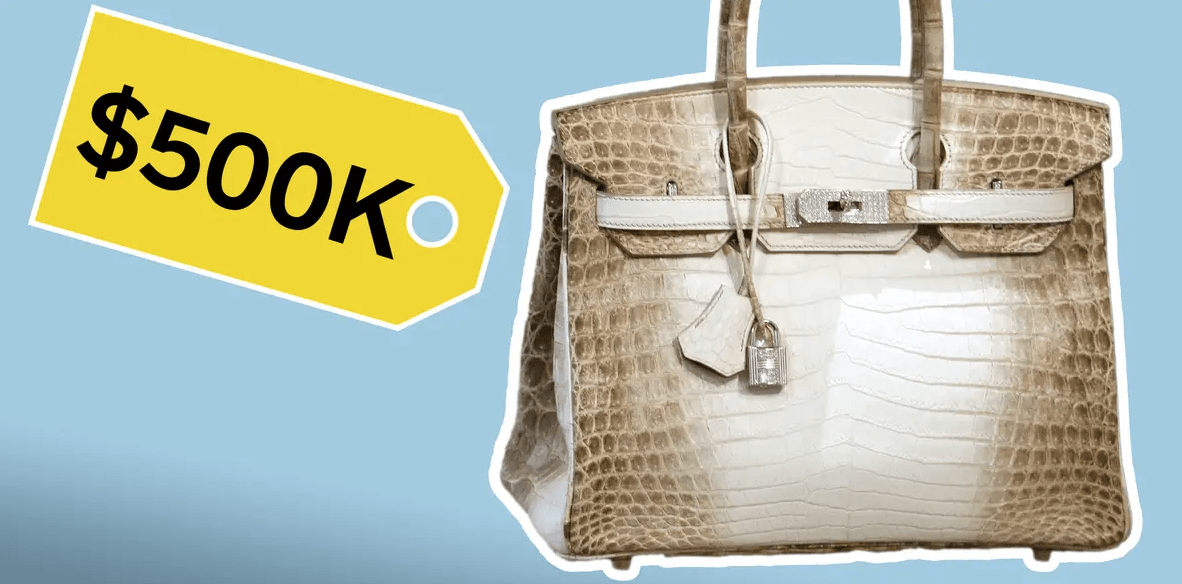

It hasn’t always been like this though. The original Birkin retailed at $2000 in 1984, and although that was a hefty number at the time, the current five figure plus number may give more sticker shock. Today, the rarest model fetches upwards of $500,000. From an investment perspective, this is a prospect that is as enticing as it is lucrative. After all, in the world of stocks and commodities, the aim of the game is to buy low and sell high. This way, one can make a profit offloading assets when prices increase. Applying this logic to a Birkin, the average model from an Hermes boutique can range anywhere from $9,000 USD to $15,000 USD.

Special order Birkin 30 @pursebop

The resale and consignment market, however, can sometimes list these same models for almost double their purchase price- especially with limited use and during times of scarcity and high demand. This allows certain consumers to not only get back their initial spend, but also make some cash in hand. When it comes to resale, the Birkin and Kelly definitely outperform their competitors and counterparts from brands like Dior and Gucci, whose items tend to be harder to break even on.

The reason for this awe inspiring financial phenomenon boils down to Hermes’ production policy. A limited number of Birkins and Kellys are produced each year. However, the way Hermes markets these bags as the pinnacle of luxury and symbol of success, continues to send consumers into a frenzy.

Image Courtesy: Business Insider

The road to a Birkin or Kelly is rarely a straight one. Unlike other brands, one cannot simply walk into an Hermes boutique, pick a bag off the shelf and walk out. As a heritage house, Hermes seeks to build lasting relationships with its clients, and have these individuals represent the house, and all it stands for, as ambassadors. As a result, Hermes is one of the only businesses across all industries that can choose to be selective with demand for its products. Unlike the majority of entities, increased demand is always welcome, and provides ample boost to financials. However, Hermes is not a ‘quantity establishment.’ Despite huge demand for its items, the brand is very particular about who it chooses to offer them to.

Image Courtesy: Forbes

Essentially, the simple concept of supply and demand perfectly describes the business of Kellys and Birkins. When demand is high and supply is low, a stock shortage is created. When a shortage exists, the market naturally commands a higher price point for an item, and suppliers are able to increases prices without losing demand. In other words, if everyone wants a Birkin, and there are only a few Birkins out there, the desire to acquire this bag fuels consumers’ willingness to pay and increases their threshold for spending.

Our business is about creating desire…

Axel Dumas, CEO Hermes, to Forbes (2014)

Now, of course, not every Birkin lover admires the handbag like a stock portfolio. For many consumers, a Birkin is a lifelong investment, not financially, but in terms of longevity. Birkins are well crafted, artisan, works of art- at least according to Hermes. Each bag is handmade by a single Hermes artisan, who spends anywhere from one to two days dedicated entirely to constructing that one bag. In today’s reality of mass production and automation, this antiquated method of production is what makes Hermes and its bags so unique and superior to equivalents in the market. Due to the high level of craftsmanship and quality of materials, a Birkin can last years, even with daily use.

Image Courtesy: Christian Sinibaldi/ The Guardian

Like a good quality pair of pants, costing slightly more initially, the superiority of the materials allows for them to last years without having to replace them. This same logic applies to the Birkin. A $10,000 investment, stretched out over a period of 5-10 years, works out to approximately $1,000 – $2,000 per year- a cost per wear equal to less than that of most new handbags from other designers.

Thus, the Birkin bag is an investment in every sense of the term. It is one of the only bags that will not only last years, but best retains value subject to use. Like speculative stocks, commodities, bonds and the like, fluctuates in terms of value. On the other hand, it is more than a virtual paper instrument. Rather, it has beauty and functionality. As such, it is easy to see why it is considered by many to be the ultimate investment and the apex of luxury. We expect it will continue setting the standard of excellence in the industry for years to come…

Love, Pursebop

XO

Updated: July 12th, 2021

Comments